Subtract that amount from $1700 to find the GST you paid. Do the same thing for $1700, and you’ve got your subtotal. As you can see, all you have to do to get the total before GST is divide by 1.05. The difference between this and the after-tax amount is the GST: $63 – $60 = $3. What is the procedure for subtracting GST from a total? The receiver of goods and/or services is obligated to pay GST instead of the provider under the reverse charge method. What is reverse GST, and how does it work?

#HOW TO CALCULATE GST IN EXCEL HOW TO#

How to Work Out Sales Tax By Working Backwards From Total How can you figure out how much tax you’ll have to pay on a total? To double-check your numbers, use an online base price calculator. For instance, if your total is $10 and your salestax is 7%, your basic price is $9.35.

1,180.Īnswers to Related Questions What method do you use to determine the base price?Īdd the salestax % to the grand amount of the item.

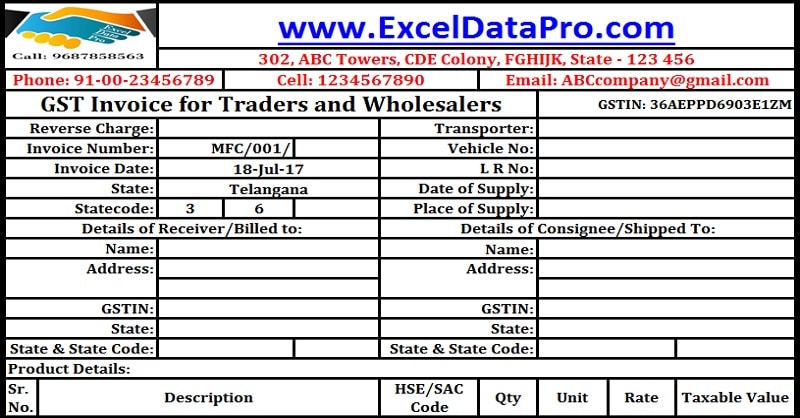

To calculate a price omitting the lower rate of VAT (5 percent), divide the price including VAT by 1.05.Ī basic explanation of GST computation is as follows: If an item or service costs Rs. How do I compute VAT included in this case?ĭivide the price containing VAT by 1.2 to get a price without the normal rate of VAT (20%). Step 6: Make any necessary changes to the additional information.Step 5: Decide on the goods or services to be provided.Step 2: Decide on the invoice and payment due dates.

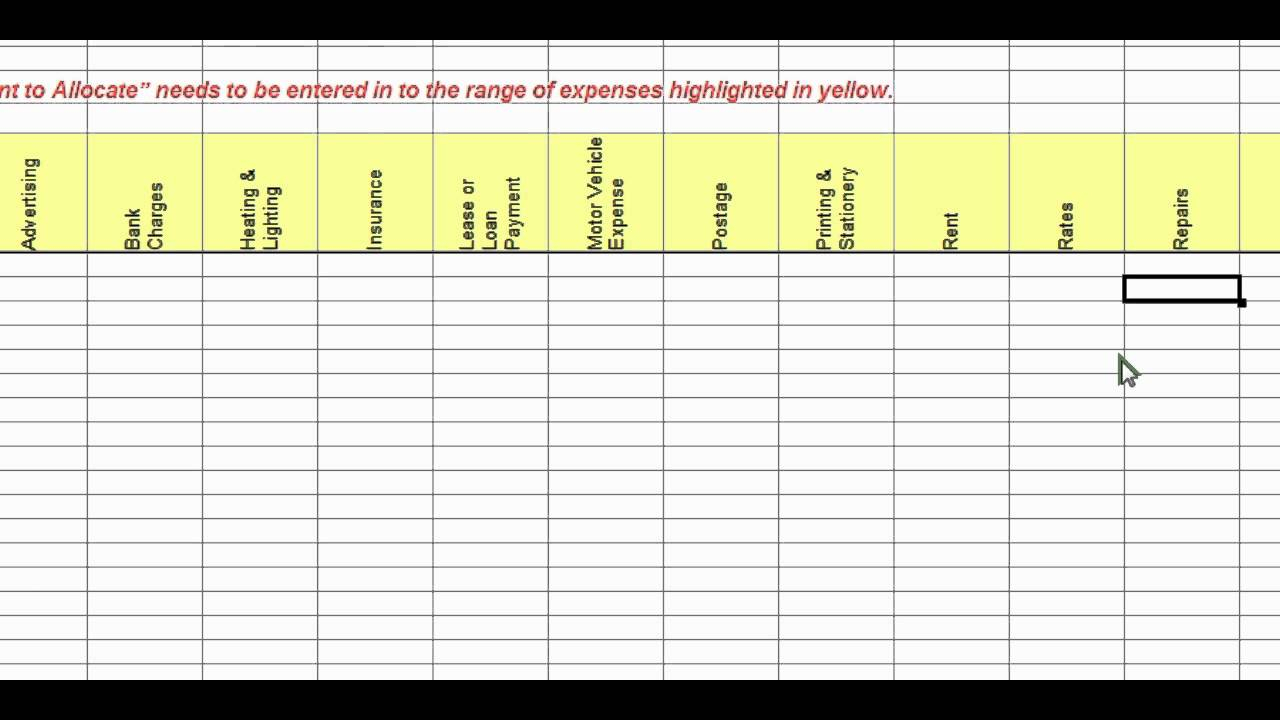

The first step is to create an invoice.Divide the total revenues by 1.0725 if the tax rate is 7.25 percent.Īlso, how can I produce a GST invoice in Excel? To produce a GST bill onLEDGERS, follow the steps below. Divide the entire amount of revenues by 1.06, for example, if the tax rate is 6%. B5 has been multiplied by 0.15 in the example below, which is the same as 15%.Īs a result, how can I convert GST to inclusive?ĭivide the receipts by 1 + the tax rate to get the GST that is included in a company’s receipts from taxable goods. Simply put the two figures together to obtain the total including GST. To do so, just double the amount, excluding GST, by 15% (or 0.15). Let’s begin by determining the GST component of a GST-free sum. The “gst reverse calculation formula” is a formula that can be used in Excel to calculate GST inclusive. This article will present some methods for calculating GST inclusive with the exception that I am only going to focus on one method because it is easy to follow and takes very little time. In Excel, you can calculate GST in a variety of ways.

0 kommentar(er)

0 kommentar(er)